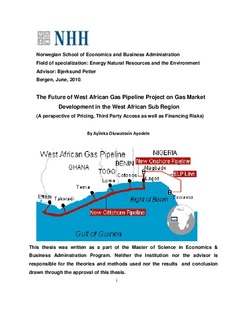

The future of West African gas pipeline project on gas market : development in the West African sub region

Master thesis

Permanent lenke

http://hdl.handle.net/11250/168585Utgivelsesdato

2010Metadata

Vis full innførselSamlinger

- Master Thesis [4372]

Sammendrag

Over the years, there has been global interest in the energy sector and its mechanism

especially the huge and irreversible capital outlay ploughed into this industry. This

interest has been strengthened by pivotal roles played by most energy (oil) producing

countries of the world such as Norway, Russia, Saudi Arabia, Venezuela, Iran, Nigeria

etc in world economics as well as the advancement in the study of Petroleum

Economics.

This thesis examines the future of the West African Gas Pipeline Project on Gas Market

development in the West African Sub Region exploring issues of pricing, third party

access, finance and financing risk.

I study the characteristics of gas market as a natural monopoly and proceeded to an

overview of the nature of the gas industry in some European countries. Subsequently, I

look at the theoretical approach to increasing gas supplies with a view to study how

there could be varying incentive to invest in new gas capacity and new gas projects.

Bearing in mind the role of finance in all this, the financing risk issues are discussed at

great length while specific risks in gas projects are brought to light.

The West African Gas Pipeline is also given prominent attention exploring all the issues

that could arise during the course and after project completion. I conclude that if the

pipeline company has access to supplies from more than one source, it would at least in

the simplest cases buy only the cheapest source and the cost of gas from the next

cheapest source would effectively put a limit on how much the cheapest supplier could

get for his gas.